Not known Facts About Feie Calculator

Table of ContentsUnknown Facts About Feie CalculatorFeie Calculator for BeginnersThe 25-Second Trick For Feie CalculatorNot known Facts About Feie Calculator9 Simple Techniques For Feie Calculator7 Simple Techniques For Feie CalculatorThe Only Guide to Feie Calculator

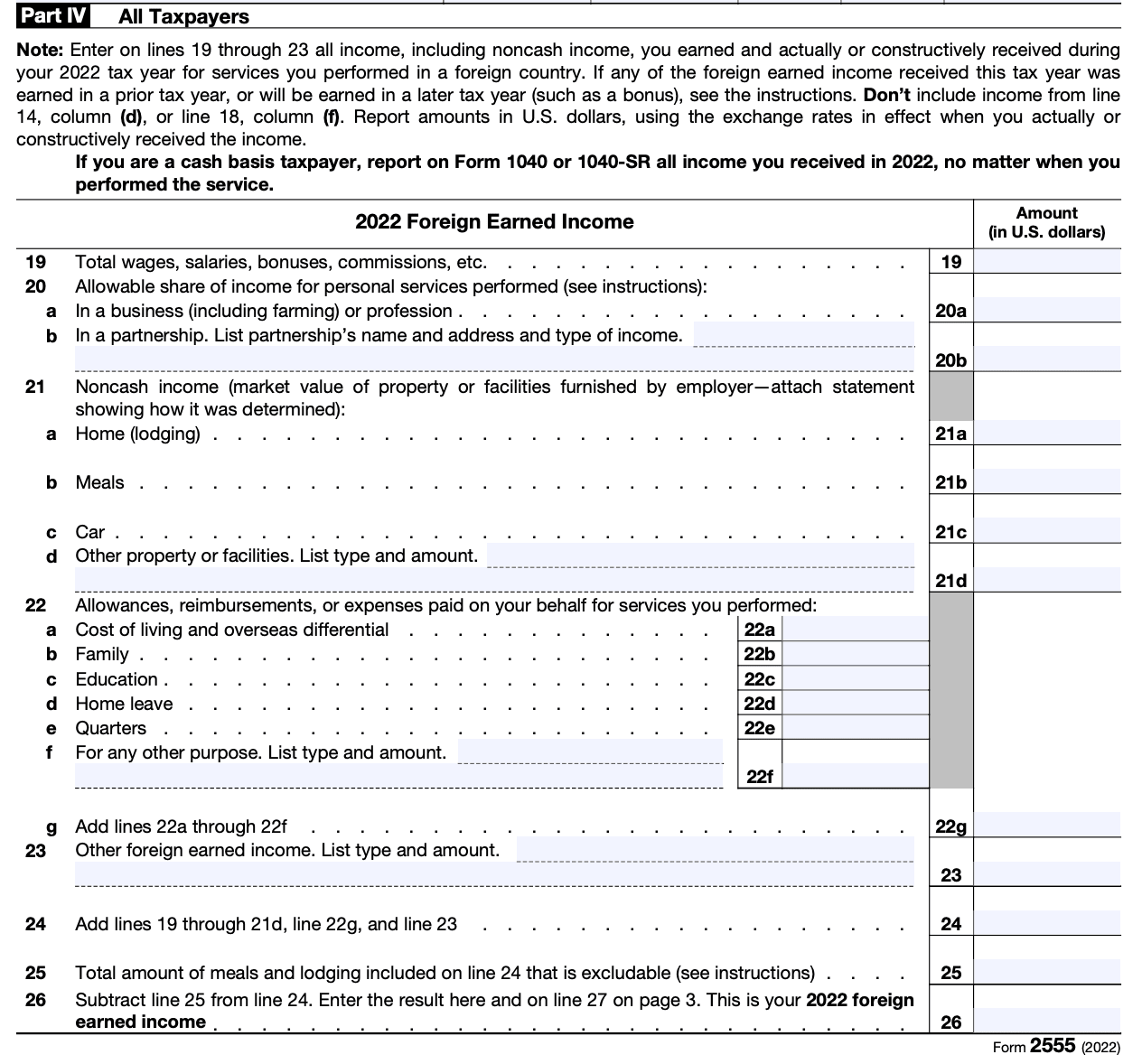

If he 'd regularly traveled, he would instead finish Component III, detailing the 12-month period he satisfied the Physical Presence Test and his travel background. Step 3: Reporting Foreign Income (Part IV): Mark earned 4,500 per month (54,000 each year).Mark calculates the currency exchange rate (e.g., 1 EUR = 1.10 USD) and transforms his wage (54,000 1.10 = $59,400). Given that he stayed in Germany all year, the portion of time he stayed abroad during the tax is 100% and he enters $59,400 as his FEIE. Finally, Mark reports total salaries on his Type 1040 and gets in the FEIE as an adverse quantity on Arrange 1, Line 8d, minimizing his taxed earnings.

Picking the FEIE when it's not the most effective choice: The FEIE might not be ideal if you have a high unearned income, gain more than the exemption restriction, or live in a high-tax country where the Foreign Tax Debt (FTC) might be a lot more useful. The Foreign Tax Obligation Debt (FTC) is a tax obligation decrease approach commonly used together with the FEIE.

The 45-Second Trick For Feie Calculator

expats to offset their U.S. tax debt with foreign earnings taxes paid on a dollar-for-dollar decrease basis. This suggests that in high-tax nations, the FTC can typically remove U.S. tax financial debt completely. Nonetheless, the FTC has restrictions on eligible tax obligations and the maximum insurance claim amount: Eligible tax obligations: Only revenue taxes (or taxes in lieu of earnings tax obligations) paid to international governments are eligible.

tax liability on your international income. If the international tax obligations you paid surpass this restriction, the excess international tax can typically be continued for approximately 10 years or carried back one year (using a modified return). Maintaining exact documents of international earnings and taxes paid is for that reason essential to computing the appropriate FTC and maintaining tax conformity.

migrants to minimize their tax obligation responsibilities. If a United state taxpayer has $250,000 in foreign-earned income, they can omit up to $130,000 utilizing the FEIE (2025 ). The remaining $120,000 might then be subject to tax, but the united state taxpayer can possibly apply the Foreign Tax obligation Credit scores to offset the taxes paid to the foreign country.

Feie Calculator for Beginners

Initially, he offered his U.S. home to develop his intent to live abroad completely and requested a Mexican residency visa with his wife to aid meet the Authentic Residency Test. In addition, Neil protected a long-term building lease in Mexico, with plans to at some point purchase a property. "I presently have a six-month lease on a residence in Mexico that I can prolong another six months, with the purpose to acquire a home down there." Neil points out that purchasing residential property abroad can be challenging without initial experiencing the location.

"We'll most definitely be outside of that. Also if we come back to the United States for doctor's visits or company phone calls, I question we'll invest greater than thirty days in the US in any provided 12-month duration." Neil emphasizes the relevance of stringent tracking of U.S. gos to. "It's something that people require to be actually thorough about," he claims, and encourages expats to be cautious of usual blunders, such as overstaying in the U.S.

Neil is cautious to tension to U.S. tax authorities that "I'm not performing any type of organization in Illinois. It's simply a mailing address." Lewis Chessis is a tax consultant on the Harness system with considerable experience assisting united state citizens browse the often-confusing realm of global tax compliance. Among the most usual misunderstandings amongst united state

The Only Guide to Feie Calculator

tax return. "The Foreign Tax Debt allows people functioning in high-tax nations like the UK to counter their U.S. tax liability by the quantity they have actually currently paid in tax obligations abroad," states Lewis. This ensures that expats are not tired twice on the exact same income. Nevertheless, those in reduced- or no-tax countries, such as the UAE or Singapore, face additional difficulties.

The prospect of reduced living costs can be tempting, but it typically comes with trade-offs that aren't promptly apparent - https://anotepad.com/notes/qgw6fkfg. Real estate, as an example, can be more budget-friendly in some nations, but this can indicate jeopardizing on framework, safety, or access to dependable utilities and services. Cost-effective residential or commercial properties could be located in areas with inconsistent internet, minimal mass transit, or undependable healthcare facilitiesfactors that can significantly influence your everyday life

Below are several of the most often asked inquiries about the FEIE and various other exemptions The International Earned Income Exemption (FEIE) allows united state taxpayers to leave out approximately $130,000 of foreign-earned income from federal income tax, decreasing their U.S. tax obligation obligation. To qualify for FEIE, you have to satisfy either the Physical Visibility Test (330 days abroad) or the Authentic House Examination (confirm your primary house in an international nation for a whole tax year).

The Physical Presence Examination likewise needs U.S. taxpayers to have both a foreign revenue and an international tax obligation home.

Unknown Facts About Feie Calculator

An earnings tax obligation treaty between the united state and an additional country can assist stop dual tax. While the Foreign Earned Income Exclusion lowers taxed revenue, a treaty may supply fringe benefits for eligible taxpayers abroad. FBAR (Foreign Savings Account Report) is a called for filing for united state citizens with over $10,000 in international economic accounts.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax obligation advisor on the Harness platform and the creator of The Tax Guy. He has more than thirty years of experience and now focuses on CFO services, equity settlement, copyright taxes, cannabis tax and divorce associated tax/financial preparation matters. He is an expat based in Mexico.

The international earned income exclusions, occasionally described as the Sec. 911 exemptions, omit tax obligation on incomes gained from functioning abroad. The exclusions comprise 2 parts - a revenue exclusion and a housing exemption. The adhering to Frequently asked questions go over the benefit of the exemptions consisting of when both partners are expats in a general way.

See This Report about Feie Calculator

The income exemption is currently indexed for rising cost of living. The maximum annual revenue exclusion is $130,000 for 2025. The tax obligation benefit excludes the earnings from tax obligation at bottom tax obligation rates. Formerly, the exclusions "came off the top" decreasing revenue based on tax obligation at the leading tax obligation rates. The exemptions may or might not lower revenue made use of for various other purposes, such as individual retirement account limitations, youngster credit scores, individual exemptions, etc.

These exclusions do not exempt the earnings from United States taxation but merely supply a tax decrease. Note that a single individual working abroad for every one of 2025 that made about $145,000 without any other revenue will have taxed income decreased to zero - successfully the same solution as being "free of tax." The exemptions are calculated every day.

If you went to organization conferences or seminars in the United States while living abroad, income for those days can not be left out. Your incomes can be paid in the US or abroad. Your employer's place or the location where earnings are paid are not consider receiving the exclusions. FEIE calculator. No. For United States tax it does not matter where you maintain your funds - you are taxable on your around the world income as an US individual.